Total taxes taken out of paycheck

Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124. -Withhold 145 percent of each employees taxable pay for Medicare tax purposes until they earn a total of 200000 for the.

Understanding Your Paycheck

These are contributions that you make before any taxes are withheld from your paycheck.

. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124. Together these are called FICA taxes and your. You as an employer must also pay this tax.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Now you claim dependents on the. If you dont file a tax return you may face penalties and interest.

Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or. For a single filer the first 9875 you earn is taxed at 10. For example if you earn 2000week your annual income is.

If you earn 50000 before taxes and you contribute 2000 of it to your 401 thats 2000 less youll be taxed on. The employer portion is 15 percent and the. What happens if taxes arent taken out of paycheck.

Discover The Answers You Need Here. What percentage of taxes are taken out of payroll. When you start a new job you fill out a W-4 form and the information on this form tells your employer how much to withhold in taxes from each of your.

You face the same problem f you file a return and dont pay the taxes. What is the percentage that is taken out of a paycheck. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

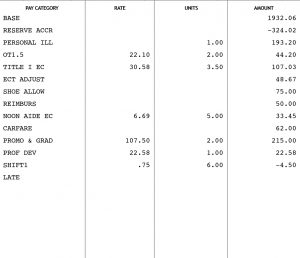

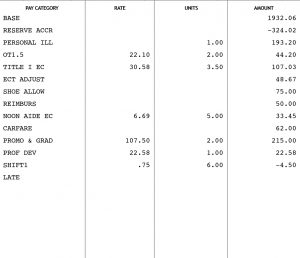

Amount taken out of an average biweekly paycheck. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. How Your Iowa Paycheck Works.

That changed in 2020. Total income taxes paid. An example of how this works.

Until 2020 you could reduce the amount of taxes taken out of your paychecks by claiming allowances on your W-4. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Every employer is expected to withhold 62 percent of your gross income for Social Security up to income of 132900 for 2019.

Federal income taxes are paid in tiers. For each pay period your employer will withhold 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes.

If you are self-employed you are responsible for paying the full 29 in Medicare taxes. And 137700 for 2022Your employer must also pay 62 percent. Total income taxes paid.

When you file your tax return youd. Your employer matches these contributions so the total FICA contributions are double what you pay. What percentage is taken out of paycheck taxes.

Paycheck Calculator Online For Per Pay Period Create W 4

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Irs New Tax Withholding Tables

Paychecks Payroll

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Hrpaych Yeartodate Payroll Services Washington State University

Pay Stub Meaning What To Include On An Employee Pay Stub

Taxes On Paycheck On Sale 52 Off Www Ingeniovirtual Com

Tax Information Career Training Usa Interexchange

Check Your Paycheck News Congressman Daniel Webster

Understanding Your Paycheck Youtube

Payroll Taxes Here S A Breakdown Of What Gets Taken Out Of Your Pay And What You Are Taxed On Youtube

Understanding Your Paycheck Credit Com

What Is Casdi Employer Guide To California State Disability Insurance Gusto

Paycheck Taxes Federal State Local Withholding H R Block